International Private Certifications Body for Entrepreneurs, Managers & CEOs Worldwide!

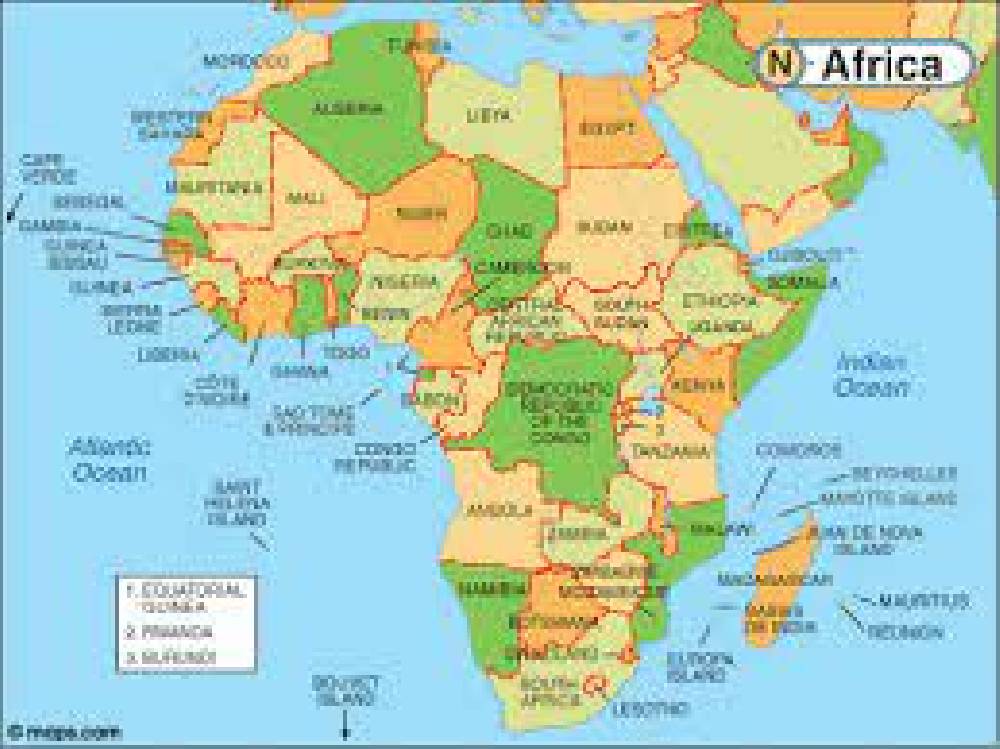

The involvement of the NEP7 in infrastructural development in Africa occurs in a context of a disrupted global economy. This disruption involves a change in the centre of gravity of global growth, a sustained boom in energy prices since 2002, and a growing recognition that Africa is emerging as a key strategic site for the expansion of commodity production. Since much economic infrastructure is wholly or partially required to export commodities, the sustained commodity boom has important implications for infrastructural investment, and particularly for investment in economic infrastructure.

Access to commodities is not the only reason why the NEP7 have played an important role in Africa’s infrastructural development. Africa represents a rapidly growing market, and construction firms in the NEP7 have distinctive competences developed in meeting the needs of their domestic economies, which often have similar operating environments to Africa. Further, in the search to widen their economic and geopolitical spheres of influence, governments in the NEP7 have increased their aid programmes to Africa, often providing support for their private sector to participate in African infrastructural development, and often involving support for social infrastructure as well as economic infrastructure. Moreover, as observed in an earlier UNOSAA Report (UNOSAA, 2009), the mode of involvement of some of the NEP7 (particularly, but not exclusively, China) occurs in a framework, which departs from the Washington Consensus, which has characterised DAC-economy involvement in Africa, and this on occasion provides them with a competitive edge over northern rivals. Often, NEP firms are not subject to the transparency, environmental and labour standards that govern DAC economies operations in Africa. In some circumstances this provides NEP firms with the capacity to underbid firms from Africa’s traditional partners.

This Report reviews the operations of the NEP7 in Africa’s infrastructure by drawing on the World Bank’s PPIAF database and complementing this with an extensive search of the internet and information provided by key informants. This produces a database of 239 projects between 2000 and 2010 – the listing of individual projects is provided in the tables at the end of each of the country Case Studies However, although this is a unique new database, it only provides a glimpse of NEP7 involvement in African countries. It is not possible to determine the representiveness of this sample, but it is a sample, which does provide an important insight into the rapidly growing presence of NEP economies in Africa’s infrastructural sectors, and the distinctive character of this involvement.

Three sets of lenses are utilised to assess the character of NEP7 involvement in African infrastructure: