International Private Certifications Body for Entrepreneurs, Managers & CEOs Worldwide!

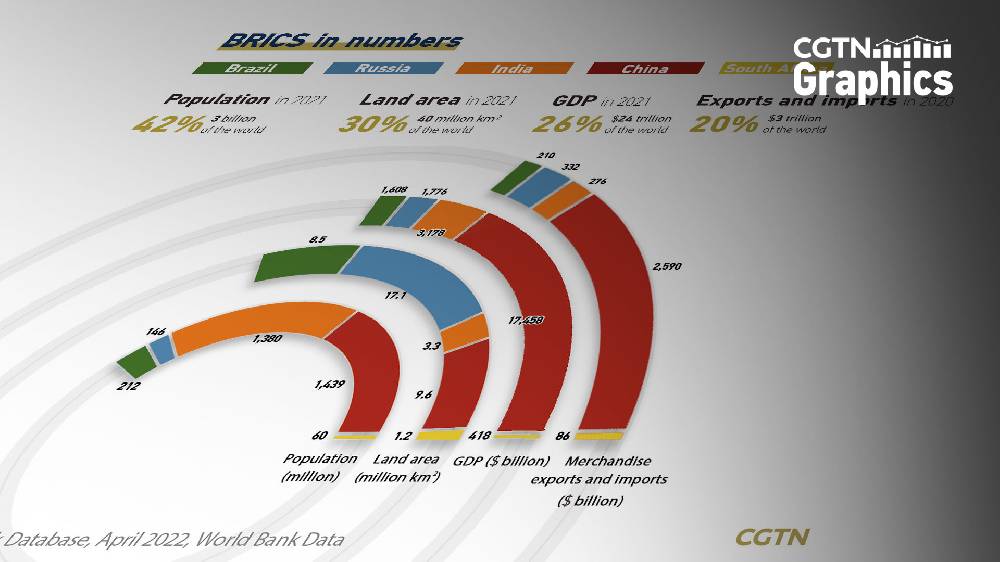

The BRICs These four countries contain more than 42% of the world’s population and also have a higher than average birth rate, especially India and Brazil. Each country’s profile is presented in Table 1. Thus, their numerical weight of the world’s population will not drastically decline during the next few decades. At present, the share of these economies in the global capital markets is about 3.5%. (Katz, 2015) What tends to be ignored about the BRIC countries is that despite the reduction in the number of poor people in recent years, especially in India and Brazil, poverty is still widespread. (Bond and Garcia, 2015; Cornia, 2014) Inequality in China is increasing as its Gini Coefficient has risen sharply in the last two decades; the same is true for Russia. India’s Gini Coefficient is officially calculated on the basis of consumption expenditure, which has been criticised for not providing very reliable income data. Inequality has accelerated since the neoliberal economic reforms were launched in 1991 and as a result the number of US dollar billionaires has grown rapidly in India. Over two decades of neoliberal economic policies in India have failed to reduce poverty and unemployment. Three-quarters of the country’s population relies on the agriculture sector for their incomes and this remains stagnant; moreover, the manufacturing sector has not experienced any breakthroughs, especially in employment opportunities (Siddiqui, 2014a). As shown in Table 1, the GDP growth rates and values of exported goods differ among the BRIC economies. China has been the most successful in terms of higher GDP growth rates and exports, while India’s growth performance has been second. Similarly, in terms of the inflow of foreign capital, which is seen as the most important component in neoliberal growth strategy, China is also seen as the top FDI destination country, as shown in Table 2. For foreign investors, Russia was the second destination after China. However, we find FDI into Russia rose sharply from US$ 12.89 billion in 2005 to US$ 36.75 billion in 2010, but still less than half amount of the total foreign investment into China. India too was successfully able to attract foreign investment from US$ 7.61 billion in 2005 to US$ 34.58 billion in 2010. (World Bank, 2012) In 2005 Brazil received US$ 15.07 billion, which was higher than India, [Type text] Page 6 but despite the rise in foreign investment to US$ 25.95 in 2010, Brazil had fallen substantially behind India (Bond and Garcia, 2015).

https://core.ac.uk/download/pdf/74212376.pdf